THE BULL MARKET

The S&P 500 bull market turned two years old October 12th, impressively clocking in with an approximate 60% gain. (LPL Research, Bloomberg 10/8/2024)

Market theology states that bull markets do not die of old age. Recessions, climbing interest rates, exogenous shocks, poor earnings, and geopolitical scenarios that are no longer contained can conspire to kill off the bull.

It can be expected that the bull entering the third year will need to maneuver around volatility, lack of certainty, and a host of other obstacles, but since the end of World War II, most bull markets that made it through their second year have gone on to enjoy a third birthday. (LPL Research, FactSet 10/10/24)

MARKET UPDATE

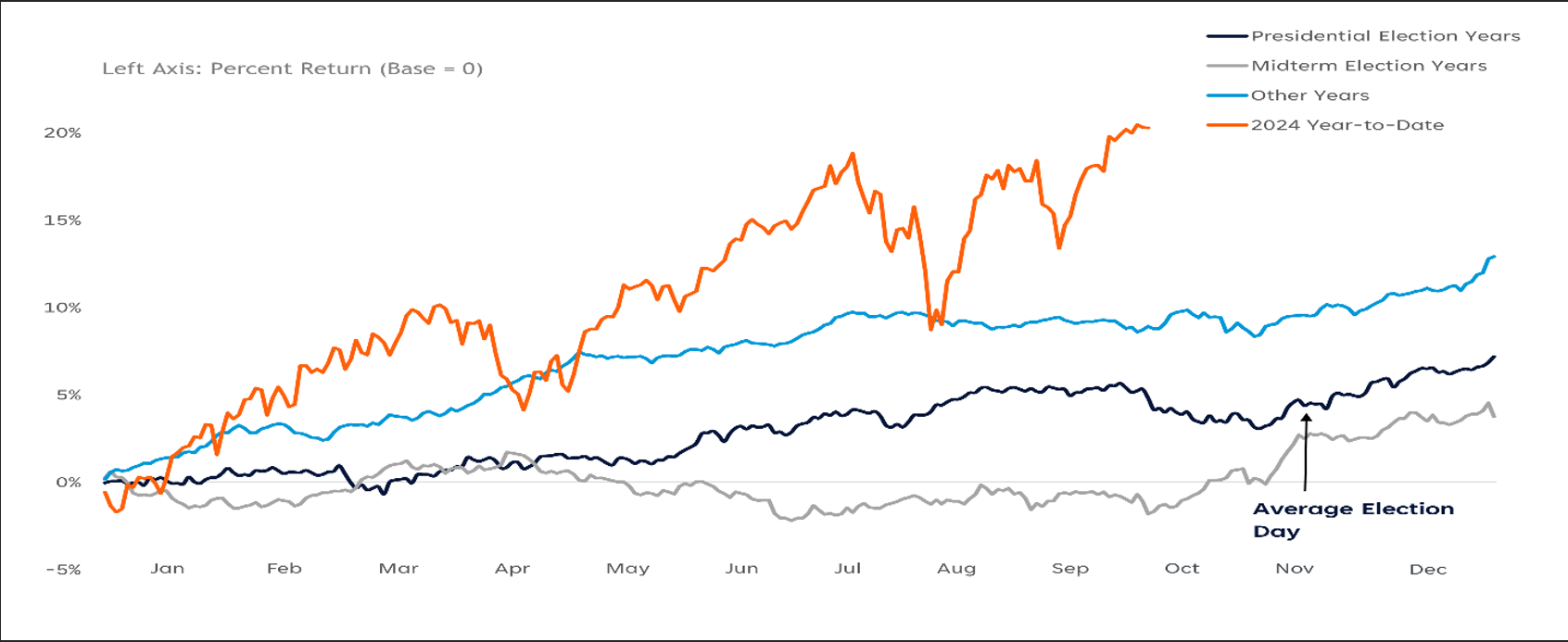

With just under a few weeks to go until Election Day, 2024 has not been a standard election season, as evidenced by assassination attempts on former President Trump and President Biden stepping down as the Democratic nominee. In the chart and commentary below, we analyze how markets have historically reacted to the presidential cycle and election outcomes.

S&P 500 | Daily Progression (1950-2024 YTD)

Source: LPL Research, Bloomberg, FactSet 09/30/24

Disclosures: All indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results. The modern design of the S&P 500 Index was first launched in 1957. Performance before then incorporates the performance of its predecessor index, the S&P 90.

WHAT TO EXPECT?

The third quarter of the final year of a presidential cycle is typically a below-average environment for stocks, as markets typically assess each candidate’s policies and chances of success in the upcoming election. In election years, on average, stocks typically find jitters right around a week before the election. Good news for stock investors is the final quarter of the presidential election cycle typically trends upwards towards a strong performance year-end. Markets generally react positively to the degree of uncertainty that is removed following the presidential election result, even if the full details of policy in the years to come are still not fully defined.

SUMMARY

The election is expected to increase short-term market volatility, with historical correlations suggesting potential stock market fluctuations tied to political uncertainty. While differing candidate policies could create specific investment opportunities across areas such as trade, energy and fiscal policy. We wish you and your family well during this upcoming election cycle, and we look forward to helping you navigate whichever direction the election takes us.